IntroductionPart 1: Understanding Hourly IncomePart 2: Disposable incomePart 3: Creating a BudgetPart 4: Savings and GoalsPart 5: Accelerating SavingsPart 6: Compounding and InterestAction Item To TakeawayLead into Session II…Beyond Labor: Introduction to Business ConceptsLead Into Session III

Introduction

- Open with:

What is something you want to buy?

Have kids go to easel and write something down. If they see something on the easel they also want just put a checkmark next to it.

Use the popular items to sort the kids into teams

Part 1: Understanding Hourly Income

Questions to pose:

“How many of you get allowance?”

“How many of you make money some other way?”

- "Let’s suppose you make $X per hour."

- Question 1: How long would it take you to save up for it?

- Question 2: What is your weekly wage? Your monthly wage? Annual wage?

[Use an example from the group, maybe something that costs $1,000 like a PC or gumball machine or bike. This will be used for further questions.]

[This is reinforcing basic math — annualizing]

Part 2: Disposable income

Before you can save for X you need to take care of necessities. As kids, you mostly have your necessities paid for but that’s not true for all kids. Some of the parents here might have needed to buy their own sneakers or backpacks when they were kids.

- Can you make a list of necessities that adults need to pay for?

- Food/Drink

- Shelter

- Transportation

- Clothes

- Utilities/Energy

- Hygiene/Medical

- Entertainment/Fun/Vacation/Recreational

- Furniture/technology (inc: phone/computer)

- Savings

Looking for these 9 categories (asking this question is like playing Family Feud)

Part 3: Creating a Budget

- Introduce the idea of pie chart and refresh “percentage” math

- The thing we are saving for is going to come out of the savings slice

Part 4: Savings and Goals

- How long does it take to save up for that $1,000 gumball machine [or whatever we are saving for] based on our savings rate?

- Understand the less recurring expenses we have or the more money we make, the higher our savings rate.

Part 5: Accelerating Savings

- How can you get the gumball machine faster?

- Spending less (there is a floor to this — you need to eat after all)

- What’s left? Earning more per hour

Working more hours (there is a ceiling to this — you need to sleep)

Part 6: Compounding and Interest

If I start with $100 and double my money every year, how much do i have after 5 years if I

- Pull my profit out every year and put it in my piggy bank?

- Let the profit stay in the business and double with rest of the initial money and accumulated profits?

$600 vs $3200

If I compound 10% every year for 5 years what’s the formula?

The impact of saving at 7% vs 8% per year starting at age 30 and holding for 40 years

Extra

"Would you rather have $1 million right now or a penny that doubles in value every day for a month? Why?”

You are 10 years old and you earn 10% year interest on $100

Your friend spends all their money and doesn’t start saving until they are 30 years old, but they earn 20% interest, twice as much as you do.

You both save until you are 50. So you saved for twice as long…40 years vs her 20 years but at half the interest rate.

Who ends up with more money?

Extra Extra

A piece of paper is .1 mm thick. How many times would you need to fold it in half to get to the moon? (Moon is about 384,000km away)

A pond has lily pads growing on it, and the lily pads double in size every day. After 30 days, the lily pad completely covers the pond. At what day do the lily pads cover half the pond?

Action Item To Takeaway

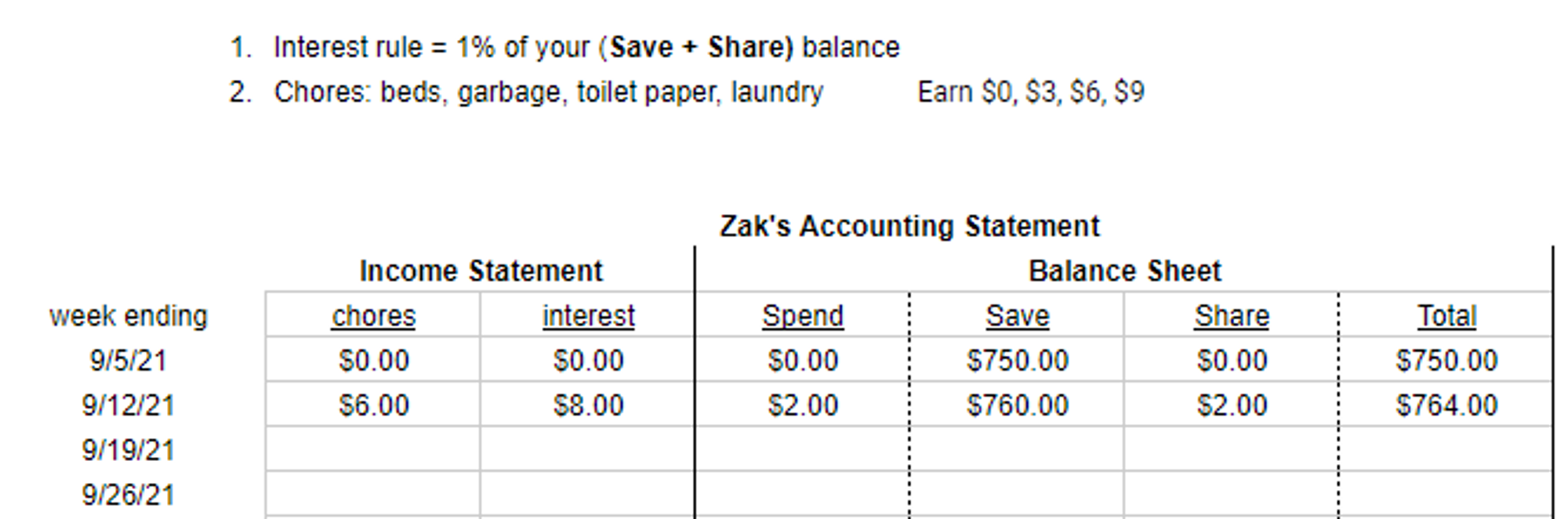

Split allowance into 3 buckets:

- Spend (like a checking account)

- Save (earns interest)

- Share (earns interest)

You must allocate at least 1/3 each to save and share

Lead into Session II…Beyond Labor: Introduction to Business Concepts

Next Session Plan: Discuss creating a business and basic accounting.

Product vs service (scalability vs exchanging time for money)

- Topics:

- Revenue, Fixed Costs, Variable Costs (COGs), Profit.

- Types of businesses: Service (e.g., dentist, dog walker) and Product (e.g., writing a book or song).

- Activity: Brainstorming business ideas and understanding different business models.

- Application: Lemonade Stand example (mix of product and service)

Lead Into Session III

Investing: Separating savings for a rainy day vs long-term savings

How to treat each of those 2 buckets