HistoryArticlesTheory-focusedApplication-focusedTwitter ThreadsVideosExtrasMoontower NotesFormulasNoteworthy Observations & Quotes

History

In timeline form:

- 1738 - Bernoulli proposed a logarithmic utility function and the concept of calculating the geometric mean for risky propositions in a paper that launched the 'expected utility theory'. This paper was later translated into English in 1954.

- 1936 - Williams focuses on cotton trading in "Speculation and the carryover," advocating for the geometric mean for calculating future prices when profits and losses are reinvested.

- 1944 - John von Neumann and Oskar Morgenstern wrote Theory of Games and Economic Behavior, a foundational text for modern game theory.

- 1948 - Claude Shannon publishes 'A Mathematical Theory of Communication', establishing information theory. The paper established the discipline of information theory and became a classic. In short, he developed the concepts of information entropy and redundancy. Shannon asserted that binary digits could be transmitted over a noisy channel with an arbitrarily small probability of error if the binary digits were suitably encoded.

- 1956 - John Larry Kelly, Jr. published 'A New Interpretation of Information Rate' at Bell Labs, introducing what is now known as the Kelly Criterion in the context of maximizing wealth growth. He showed that in order to achieve maximum growth of wealth, at every bet a gambler should maximize the expected value of the logarithm of his capital, because it is the logarithm which is additive in repeated bets and to which the law of large numbers applies.

- 1957 - Bellman and Kalaba extend Kelly’s results through dynamic programming.

- 1959 - Latané introduces the Kelly criterion in an economic context, emphasizing maximizing the geometric mean of portfolios.

- 1961 - Breiman proves the asymptotic optimality of the Kelly criterion under certain conditions.

- 1962 - Edward O. Thorp publishes Beat the Dealer, showing that blackjack can be beaten by card counting.

- 1966 - Thorp and Walden develop a winning strategy for Nevada Baccarat using the Kelly criterion.

- 1969 - Thorp suggests the Kelly criterion should replace the Markowitz criterion for portfolio selection.

- 1970 - Hakansson discusses optimal investment and consumption strategies under risk for a class of utility functions.

- 1971 - Various advancements including Radner’s balanced investment strategy, Thorp’s application of the Kelly criterion to portfolio choice, and Samuelson’s critique of the geometric-mean strategy.

- 1974 - Goldman and Merton and Samuelson critique the log-normal approximation for portfolio decision-making.

- 1975 - Kraus and Litzenberger develop a competitive equilibrium model; Miller shows the optimality of maximizing expected log each period for infinite horizon.

- 1976 - Friedman presents on the Kelly criterion; Markowitz criticizes the sequence-of-games formalization of the maximum-expected-log rule rule the criterion for asymptotic optimality adopted by Merton and Samuelson and Goldman is unacceptable, because it violates the notion that only the normalized form of the game is necessary for comparing strategies.

- 1979 - Economists take a dim view of the Kelly system, in a notable attack, Samuelson critiques the Kelly system in the Journal of Banking & Finance using words of only one syllable, ‘Why we should not make mean log of wealth big though years to act are long’ which was published in the normally polysyllabic Journal of Banking & Finance. His point was that ‘[w]hen you lose – and you sure can lose – with N large, you can lose real big.’

- 1980

- Bell and Cover use a game-theoretic model to demonstrate the effectiveness of the Kelly criterion in outperforming other gamblers.

- Thorp published 'The Kelly Money Management System' in the Gambling Times.

- 1981

- Finkelstein and Whitley extend Kelly and Breiman's results, showing the superiority of Kelly investors in long-term betting scenarios.

- Wong demonstrates that the efficacy of optimal proportional betting in blackjack shows that when using optimal proportional betting, your expected win divided by your bet size is half of your expected arithmetic win rate.

- 1983

- Gehm writes about commodity market money management, including Thorp's implementation of the Kelly criterion.

- Ethier and Tavaré show the return on investment under optimal proportional betting converges to an exponential distribution.

- 1984

- Griffin considers different measures of win rate for optimal proportional betting.

- 1985

- Ziemba and Hausch demonstrate the superior expected capital growth of Kelly investors in horse race betting.

- Pestien and Sudderth demonstrate diffusion control in continuous-time betting.

- 1987

- Heath et al. show the Kelly strategy is optimal in managing a mixed portfolio to minimize expected time to reach a financial goal.

- Ziemba simulates betting on horse races, confirming the superiority of the Kelly formula.

- 1988

- Algoet and Cover prove maximizing expected log return at each stage is asymptotically optimal.

- Ether published 'The Proportional Bettor's Fortune,' advocating for a risk-free asset policy for optimal security.

- 1990-1992

- Ralph Vince, Thomas Cover, and Joy Thomas make significant contributions to portfolio management and information theory, extending Kelly’s formula and integrating it into practical applications.

- Rotando and Thorp apply the Kelly strategy to long-term investment in S&P 500 stocks, exploring its benefits and drawbacks.

- 1993

- Aucamp provides theory and evidence on the long-run requirements for the geometric mean strategy to be optimal in various risk scenarios.

- 1995

- Vince publishes his third book on money management, further developing the 'optimal f' strategy and introducing a new portfolio construction model.

- Hakansson and Ziemba review the theory of capital growth, focusing on the growth-optimal investment strategy (the Kelly criterion).

- 1996

- Browne and Whitt derive a generalization of the Kelly criterion for gambling and investment, accounting for unknown parameter values in stochastic processes.

- 1997

- Thorp discusses the application of the Kelly criterion to blackjack, sports betting, and stock market investments.

- Cetinkaya and Parlar critique the logarithmic utility assumption for terminal wealth and propose a more general utility function, showing the non-myopic nature of optimal policy.

- 1998

- Karatzas and Shreve publish Methods of Mathematical Finance, including a section on maximizing wealth growth rate.

- 2000

- Aurell et al. apply Kelly's theory to derivative pricing in incomplete markets.

- Browne and Haigh analyze short-run properties of the Kelly strategy and its interpretation in spread betting.

- 2002

- Evstigneev and Schenk-Hoppé demonstrate the positive exponential growth of wealth through self-financing constant proportions investment strategies in certain financial markets.

- 2002-2003

- Ziemba introduces Kelly betting and its application to lotteries in a two-part article, providing an accessible review of the Kelly criterion.

- 2004

- Anderson and Faff show the significance of money management in speculative futures trading with the 'optimal f' technique.

- Ethier finds that the Kelly system maximizes the median of the gambler’s fortune.

- 2005

- Poundstone publishes Fortune’s Formula, linking gambling, information theory, stock investing, and mathematics with a focus on the Kelly system.

- 2006-2008

- Leibfarth, Piotrowski and Schroeder, and Fabozzi et al. contribute to the discussion on money management, portfolio optimization, and the practical applications of the Kelly criterion and robust optimization techniques.

- Vince and McDonnell publish significant works on portfolio mathematics and modeling, including new approaches to risk metrics and portfolio construction.

- Michaud and Michaud critique Markowitz's mean-variance optimization and advocate for Monte Carlo resampling to mitigate information uncertainty.

Articles

Theory-focused

- The Kelly Criterion by Nicky Yoder

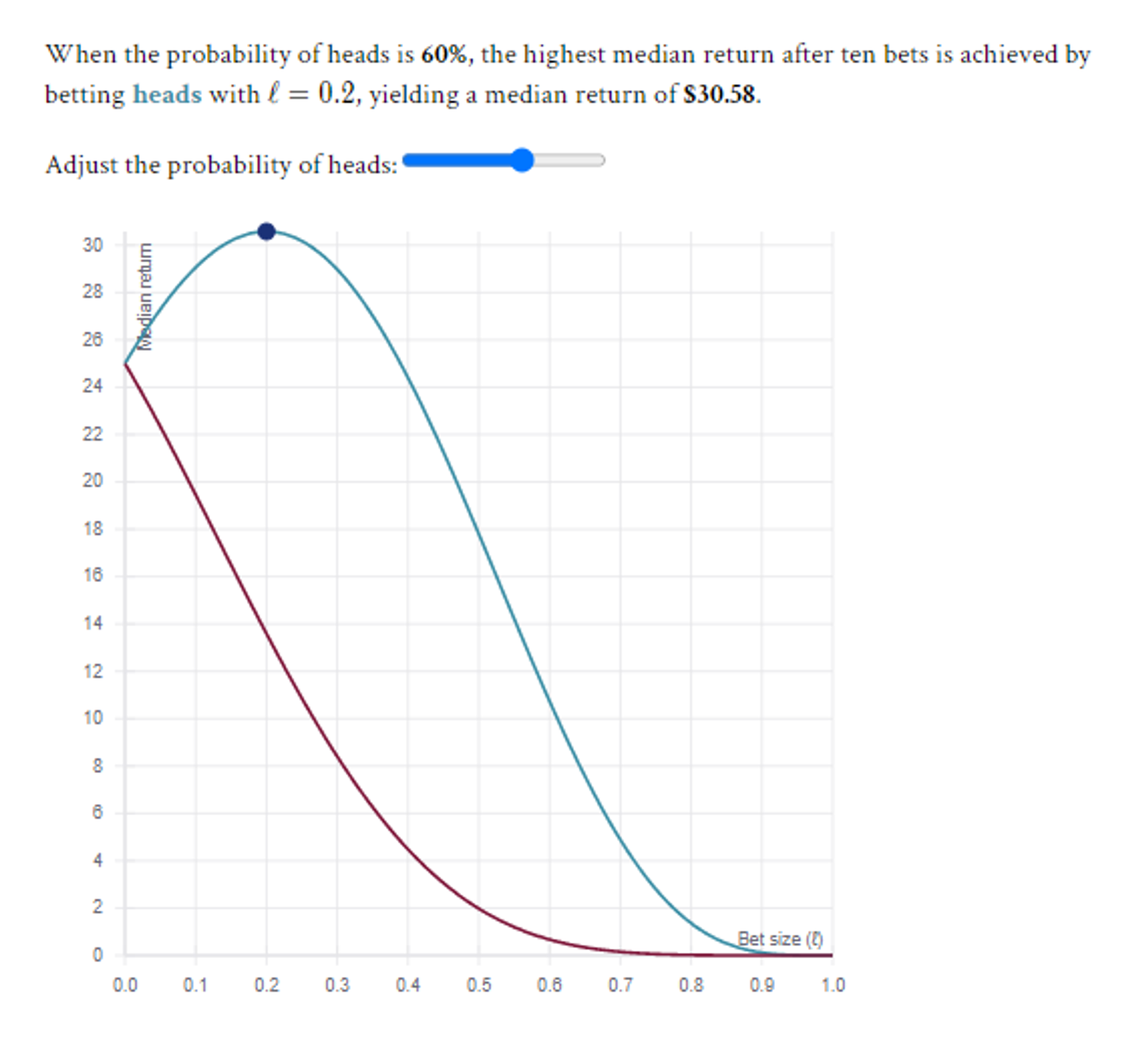

- The Kelly criterion: How to size bets (interactive) by Paul Butler

- Understanding the Kelly Capital Growth Investment Strategy by Prof William T Ziemba

Application-focused

- The Kelly Criterion by thezvi.wordpress.com

- The Kelly Criterion and the Importance of Money Management by Mauboussin

- “suppose the gambler’s wife allowed him to bet one dollar each week but not to reinvest his winnings. He should then maximize his expectation (expected value of capital) on each bet.” 13 In other words, if you employ the first strategy, you should focus on average payout calculated with the arithmetic mean. In this case, the mean/variance approach is the way to go. In contrast, the Kelly Criterion assumes you parlay your bets, and says you should choose the opportunities with the highest geometric means."

- Geometric return is the product of N returns to the Nth root minus 1

- Substantial empirical evidence shows that stock price changes do not fall along a normal distribution. 15 Actual distributions contain many more small change observations and many more large moves than the simple distribution predicts. These tails play a meaningful role in shaping total returns for assets, and can be a cause of substantial financial pain for investors who do not anticipate them. As a result, mean and variance insufficiently express the distribution and mean/variance can at best crudely approximate market results. Notwithstanding this, practitioners assess risk and reward using a majority of analytical tools based on faulty mean/variance metrics. So the mean/variance approach has two major strikes against it. First, it doesn’t work for parlayed bets (even though most investors do reinvest). Second, it doesn’t consider the verity of nonnormal distributions. Yet most mainstream economists still argue that maximizing geometric returns is the wrong way to allocate capital. Why?

- Neoclassical Economic Objections to the Kelly Criterion One of the most vocal critics of geometric mean maximization happens to be one of the most well-known and well-regarded economists in the world: MIT’s Paul Samuelson. Poundstone notes that Samuelson likes to describe the Kelly Criterion as a fallacy.

- First, he notes the geometric mean maximization strategy does not assure that you will end up with more wealth than other strategies. Since the approach is based on probability, there remains a very small chance an investor will do poorly. This low-probability, high-impact scenario may violate an individual’s utility function.

- Second, success of geometric mean maximization depends on investors staying in the market for the long run. If an investor needs access to the funds in the near-term, the benefits of compounding do not apply.

- Third, the system assumes the investment payoffs remain steady and the investment opportunities set is large enough to accommodate a rising asset base. Shifting investment payoffs undermine the system.

- Finally, Rubinstein invokes the macro-consistency test: to judge a strategy’s superiority, ask what would happen if everyone tried to follow it. His point is all investors cannot apply the geometric mean strategy successfully.

- One way to understand the difference of opinion is to distinguish between normative and positive arguments. Normative arguments stem from a view of how the world should be, while positive arguments reflect how things are and will likely be in the foreseeable future. Economists dismiss the strategy of maximizing geometric means based on a normative argument. Investors should have specific utility functions and act consistently with those functions. Since the small chance of a large loss will violate an individual’s utility function, geometric mean maximization is not right for everyone (Rubinstein’s first point). A positive argument is based on how people actually behave. Very few people take the time to quantify their utility functions, and those functions shift over time and with varying circumstances. In his famous Portfolio Selection, Markowitz advocates the geometric mean maximization approach. In spite of arguments by Jan Mossin (one of the founders of the capital asset pricing model) and Samuelson in the 1960s, Markowitz reconfirmed his endorsement of the geometric mean maximization strategy in the preface to his second edition published in 1970. Markowitz suggests utility-maximizing man “acts absurdly” over the long term.

- Why Many Money Managers Focus on Arithmetic Returns As we noted, geometric mean maximization requires an investor to be in the market over the long haul. If capital is free to come and go, however, as is the case with an open-end mutual fund, the portfolio manager may not have the luxury of thinking long-term. Even if geometric mean maximization is the best way to go, market realities may compel a short-term focus. The reasoning is straightforward: an open-end portfolio with poor short-run performance faces the very real prospect of losing assets. In turn, portfolio managers have a strong incentive to focus on the investment ideas they perceive will do well in the short term, even at the expense of ideas offering higher rates of return over the long term. Geometric mean maximization simply does not make sense for a portfolio manager in this short-term mindset.

- Poundstone highlights another important feature of the Kelly system: the returns are more volatile than other systems. [Kris: Poundstone is arguing for partial Kelly] While the Kelly system offers the highest probability of the most wealth after a long time, the path to the terminal wealth resembles a roller coaster. Another important lesson from prospect theory—and a departure from standard utility theory—is individuals are loss averse. Investors checking their portfolios frequently, especially volatile portfolios, are likely to suffer from myopic loss aversion. 24 The key point is that a Kelly system, which requires a long-term perspective to be effective, is inherently very difficult for investors to deal with psychologically. It is possible to reduce the strategy’s volatility by taking partial Kelly positions.

- Mean/variance is not the best way to think about maximizing long-term wealth if you are reinvesting your investment proceeds. If you face a one-time financial decision, you want to maximize your arithmetic mean. But with repeated favorable opportunities—either through time or diversification—chances are you will do better in the long term by maximizing geometric mean. Mean/variance may be deeply embedded in the investment industry’s lexicon, but it doesn’t do as good a job at building wealth as a Kelly-type system.

- Applying the Kelly Criterion is hard psychologically. Assuming you do have an investment edge and a long-term horizon, applying the Kelly system is still hard because of loss aversion. Most investors face institutional and psychological constraints in applying a Kelly-type system.

Notes

How do economists reconcile the apparently conflicting ideas that maximizing geometric mean will almost certainly result in higher wealth (theorem) with the notion that this approach is possibly inferior to other strategies (corollary)?

Perhaps the clearest explanation of the mainstream economics case comes from Mark Rubinstein.

Conclusions:

- Woody Was Right by Drew Dickson (Albert Bridge Capital)

- Position Sizing Utilizing the Kelly Growth Criterion, January 2013, Market Folly

- Understanding Kelly for Portfolio management, Cameron Hight, August 2010, Alpha Theory

- St. Petersburg Paradox (How To Not Pull An FTX) by Taylor Pearson

- The Five Investor Camps that Try To Beat the Stock Market by Prof William T Ziemba

- What Gamblers Can Teach the Buy-and-Hold Crowd by Victor Haghani

- with my highlights

- Kelly’s Criterion, Founders, Startups and Bet size by Prof Jawaad Farid

Twitter Threads

- Kelly Criterion by @10kdiver

- Kelly Criterion by @FabiusMercurious

Videos

- Capital Allocation and Risk Management (Kelly) by Dr. Ernest Chan (100 min)

Extras

- Bet Sizing Is Not Intuitive by Moontower

- Fortune’s Formula on The Kelly Criterion by Moontower

Moontower Notes

Formulas

Kelly Formula

where:

= /

or

where:

=

- Special Case: Even money odds

or

- Special Case: Loss Percent = 100%

where:

=

- For quick calculation for even money bets, you can use this rule: bet such that you are trying to win a percentage of your bankroll equal to your percent edge. In the above case, you win 60% of the time and lose 40% on a 1:1 bet, so you on average make 20%, so try to win 20% of your bankroll by betting 20% of your bankroll.

Noteworthy Observations & Quotes

- Two keys are needed to unlock success in professional gambling, trading and investing:

- Profitable opportunities

- Sizing investments/bets (correctly)

- A trader with a mediocre strategy and a great risk model will become fairly successful. A trader with a great strategy and a mediocre risk model will become bankrupt.

- The Kelly Criterion only defines the 'Optimal' bet to maximize return. It does not use caution or assign value to risk. It is limit not a goal!

- Ask what maximizes wealth for the median outcome. That will also be the solution to optimal Kelly fraction.